Investing is both an art and a science. It is a careful balance between risk and reward, analysis and intuition. At its core, investing means putting resources to work to earn profitable returns over time.

But what makes someone a good investor? Is it the size of their portfolio or the ability to predict market movements? While these factors matter, true investing goes beyond numbers. It is about a set of traits, strategies, and a mindset that separates exceptional investors from ordinary ones, according to Grid Capital Incorporated.

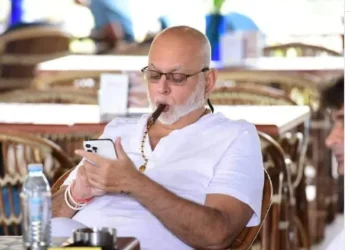

Ugandan businessman Sudhir Ruparelia is widely regarded as one of the richest people in East Africa, according to Forbes. He is the chairman and majority shareholder of the Ruparelia Group of companies. His investments cover many sectors, including banking, insurance, education, media, real estate, floriculture, and tourism.

Sudhir also invests in the Uganda Securities Exchange, where he buys shares in profitable companies. He also established Crane Bank Limited, though regulatory issues caused it to close. His ability to identify opportunities in the financial sector has earned him a strong reputation.

As a young man living in England, Sudhir built several small businesses successfully. In the 1980s, he returned to Uganda to take advantage of the country’s improving political and business stability. He started the Ruparelia Group as a small trading firm in 1985, at the age of 29, with $25,000 he had saved while working in the UK. His family had lived there after being forced into exile during the expulsion of Indians from Uganda.

From these humble beginnings, Sudhir grew his empire into major businesses. His portfolio now includes the Speke Resort Munyonyo, Kabira Country Club, which is under expansion, Speke Apartments, and Kingdom Kampala. He has also acquired properties such as Simbamanyo and Lotis after the owners defaulted on bank loans.

Investment experts note that Sudhir does not avoid risk entirely. Instead, he manages it carefully. He spreads his investments across different industries, asset types, and locations. This helps reduce losses when markets decline while giving exposure to opportunities with high growth potential.

Economists explain that Sudhir’s businesses succeed because he studies opportunities before investing. He often enters markets others fear, yet he consistently achieves success. His long-term vision allows him to focus on the bigger picture rather than short-term fluctuations. For example, he continues to invest in real estate even when the market is not performing strongly.

Trust is another reason for his success. People who have watched his career say Sudhir is reliable, which allows him to work with many business partners on large projects. Diversification also ensures his companies support one another in practical ways, including financing and office space. For instance, Crane Bank once operated in branches owned by Meera Investments, his property development company.

Experts say Sudhir is highly exposed to international business platforms, which gives him knowledge and insight that helps him avoid unnecessary loans or risky investments. This is one reason why he has avoided legal disputes over unpaid debts.

Family involvement is also central to his business strategy. His wife and children play active roles in running the Ruparelia Group, ensuring that the empire is managed professionally and can continue for generations.

Discipline is another key trait. Sudhir follows a clear investment strategy and resists chasing trends or following fads. His decisions are guided by careful planning rather than emotions.

Analytical skills are essential for success. Sudhir studies financial statements, market trends, and economic data before making investments. This research allows him to make informed choices that increase the likelihood of long-term success.

Humility is also part of his approach. Despite his achievements, Sudhir recognizes he does not have all the answers. He is willing to learn from mistakes, seek advice from experts, and adjust his strategies when needed.

Sudhir uses value investing, a strategy that focuses on finding undervalued assets with potential to grow. This method provides a margin of safety and the chance for substantial gains over time.

Experts agree that a good investor is more than someone who earns profits. They possess a combination of traits, strategies, and a mindset that prepares them for long-term success. Patience, discipline, analytical skills, risk management, continuous learning, and strategic thinking all help investors navigate complex markets.

Ultimately, being a good investor goes beyond money. It represents a philosophy of careful decision-making, resilience, and creating wealth that lasts. Sudhir Ruparelia embodies this approach, making him a model investor not only in Uganda but across the region.