By Vensor Muhumuza

Goldstar Insurance Company Limited is a leading name in Uganda’s insurance industry. In today’s fast-moving digital world, customers want quick, easy, and reliable services. Goldstar doesn’t just meet these expectations—it goes beyond them, setting new standards for how insurance works in Uganda. By using technology, focusing on customers, and staying innovative, Goldstar is shaping the future of insurance in the country.

For nearly 30 years, Goldstar has been a trusted name in Uganda. The company offers a wide range of insurance products, including health, motor, property, and business coverage. These options meet the needs of individuals, families, and companies across the country. Unlike some insurers that stick to old ways, Goldstar embraces change. It uses modern tools to make insurance faster, simpler, and more accessible for everyone.

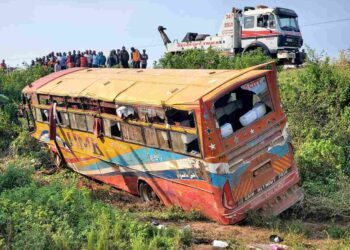

One of Goldstar’s biggest achievements is its mobile claims app, launched recently for iOS and Android users. This app lets customers report accidents, file claims, and track their progress right from their smartphones. In the past, filing a claim could take days or even weeks, causing frustration. Now, with just a few taps, customers can upload photos, videos, or GPS data to support their claims. This speeds up the process, reduces stress, and builds trust in Goldstar’s services.

The app is designed to help all Ugandans, even those in remote areas. It works offline, so people with limited or no internet can still use it. This is important in a country where internet access can be unreliable outside cities like Kampala. By making the app inclusive, Goldstar shows its commitment to serving every customer, no matter where they live.

Goldstar’s focus on technology doesn’t stop at the app. The company uses real-time notifications to keep customers updated on their claims. It also uses smart tools to fight fraud, which is a big problem in the insurance industry. For example, the app’s ability to collect GPS data and photos helps verify claims quickly and accurately. This saves time and money for both Goldstar and its customers.

The company’s leaders—CEO John Kawuma, Chief Actuary Jay Sakaria, and COO Enock Mudadi—play a big role in its success. They encourage their team to think creatively and find new ways to improve. Under their guidance, Goldstar has built a reputation for reliability and excellence. They’ve also helped raise the standard for other insurance companies in Uganda, pushing the industry to be more customer-focused and modern.

Goldstar’s impact goes beyond its customers. The company runs community programs to give back to Uganda. For example, it supports health and education initiatives, helping schools and hospitals in need. These efforts show that Goldstar cares about more than just profits—it wants to make a positive difference in people’s lives.

Industry experts say Goldstar’s approach could be a model for other African countries. Many places in Africa have low insurance coverage because people find it hard to access or trust. Goldstar’s use of technology, like its mobile app, shows how insurers can reach more people, especially in rural areas. By making insurance easier to understand and use, Goldstar is helping more Ugandans protect their homes, businesses, and families.

As Goldstar approaches its 30th anniversary in 2026, it’s clear the company has no plans to slow down. It’s already exploring new ways to serve customers better, such as improving its digital platforms and adding more insurance products. Goldstar is also investing in training its staff to stay up-to-date with the latest industry trends. This ensures they can offer the best advice and support to customers.

In a time when customer satisfaction is everything, Goldstar stands out. It combines technology, trust, and a genuine care for its clients. Whether it’s helping a driver file a claim after an accident or supporting a family with health insurance, Goldstar is there when it matters most. Its commitment to innovation and quality makes it a leader in Uganda’s insurance industry.

Goldstar’s story is one of progress and possibility. By embracing technology and putting customers first, it’s not just keeping up with the future—it’s building it. As Uganda grows and changes, Goldstar will continue to lead the way, showing how insurance can be simple, fair, and helpful for everyone. With its bold vision and dedication, Goldstar Insurance is a true Ugandan success story.